Late last Friday, the Government released NZETS 2011 Facts and Figures, a 6-page report on the progress of the NZ Emission Trading Scheme. For forest owners it is not a good read – even if it tells them what they already suspected.

The report shows clearly that NZ emitters are now largely meeting their emission obligations by surrendering emission units purchased from overseas schemes. Fewer NZ forestry NZUs were surrendered in 12 months of 2011 than there were in the first six months of the scheme in the second half of 2010.

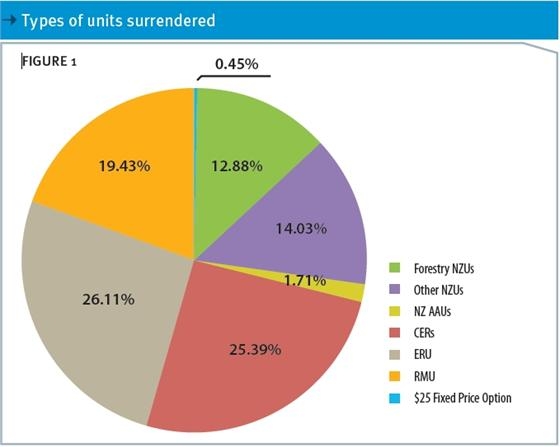

In 2011, only 12.88% of surrendered units came from NZ forestry. Seventy one per cent were offshore units, including CERs from developing countries and ERUs from developed countries. Interestingly, 19.43% were RMUs, a unit issued in Eastern Europe to forest owners for improved management of their forests. RMUs cannot be used in the European ETS, but are legal here. CERs and ERUs may be used in the EU ETS, but only as a small proportion of an emitter's commitments.

According to Carbon Match Weekly, this is not good news from a NZ forestry perspective. The unfettered flow of overseas units into the New Zealand scheme means growing trees for carbon is not a viable venture at current prices.

"New Zealand is beginning to look a bit odd in the world of emissions trading now," says Carbon Match.

"Elsewhere, including the EU, Korea, China and regional initiatives in the United States, the trend is most certainly to be turning away from international offsets. It's true that a tonne of carbon removed from the atmosphere is a tonne of carbon removed, wherever that reduction takes place. But it seems increasingly that that viewpoint is becoming outdated rhetoric."

Emission trading schemes elsewhere, says Carbon Match, are focusing more on domestic abatement projects which help decarbonise local industry and energy, in order to shore up the longer term resilience of their economies.

"In tough times many countries are focusing on what they can do to improve their own lot. An ETS which does nothing but drive cash offshore is not consistent with that and will ultimately represent a terrible loss of what could have been really dynamic capital."

To read the full MfE report, click here.

[ends]

Sources: Carbon Match Weekly & NZ Ministry for the Environment